UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

|

| SCHEDULE 14A INFORMATION |

|

| Proxy Statement Pursuant to Section 14(a) of the |

| Securities Exchange Act of 1934 |

| (Amendment No. ) |

|

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

| |

| Check the appropriate box: |

o Preliminary Proxy Statement |

¨ | o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

¨ | o Definitive Additional Materials |

¨ | o Soliciting Material underPursuant to §240.14a-12

|

American Woodmark Corporation

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

|

| American Woodmark Corporation |

| (Name of Registrant as Specified In Its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Rregistrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

|

x | No fee required. |

¨ | o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | 1) Title of each class of securities to which the transaction applies:

|

| | (2) |

| 2) Aggregate number of securities to which the transaction applies: |

| | (3) |

| 3) Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set(Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) |

| 4) Proposed maximum aggregate value of the transaction: |

¨ | |

o Fee paid previously with preliminary materials. |

¨ | o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | 1) Amount Previously Paid: |

| | (2) |

| 2) Form, Schedule or Registration Statement No.: |

Winchester, Virginia 22601

Notice of Annual Meeting of Shareholders

AMERICAN WOODMARK CORPORATION:

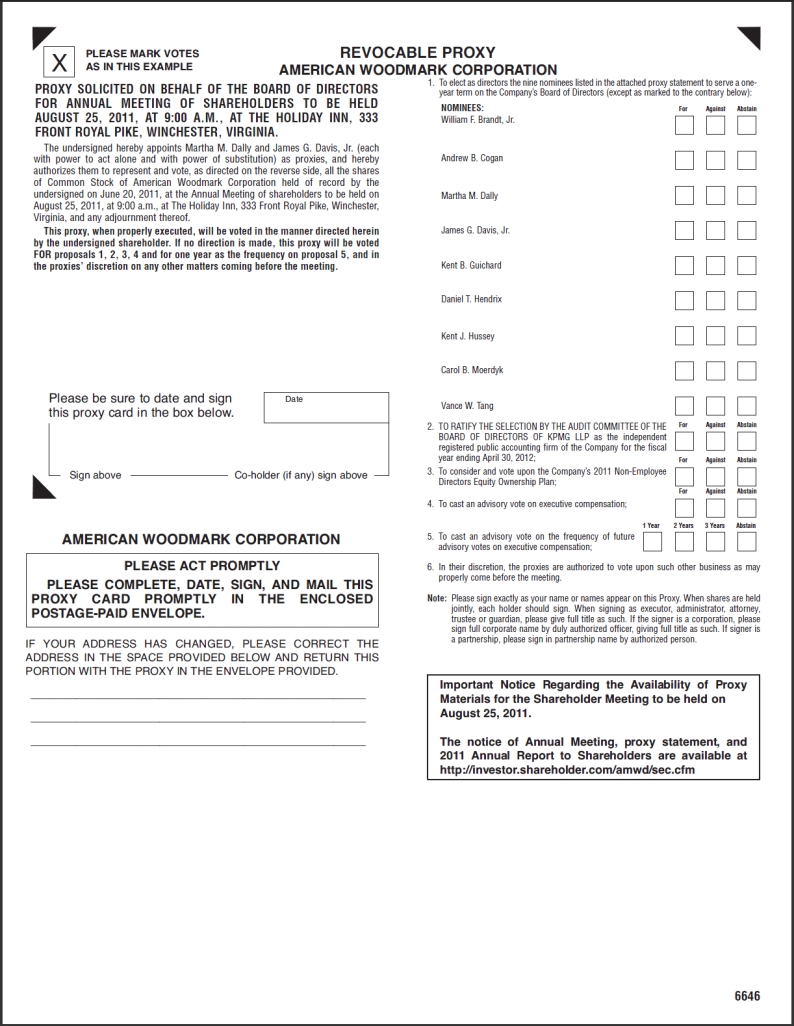

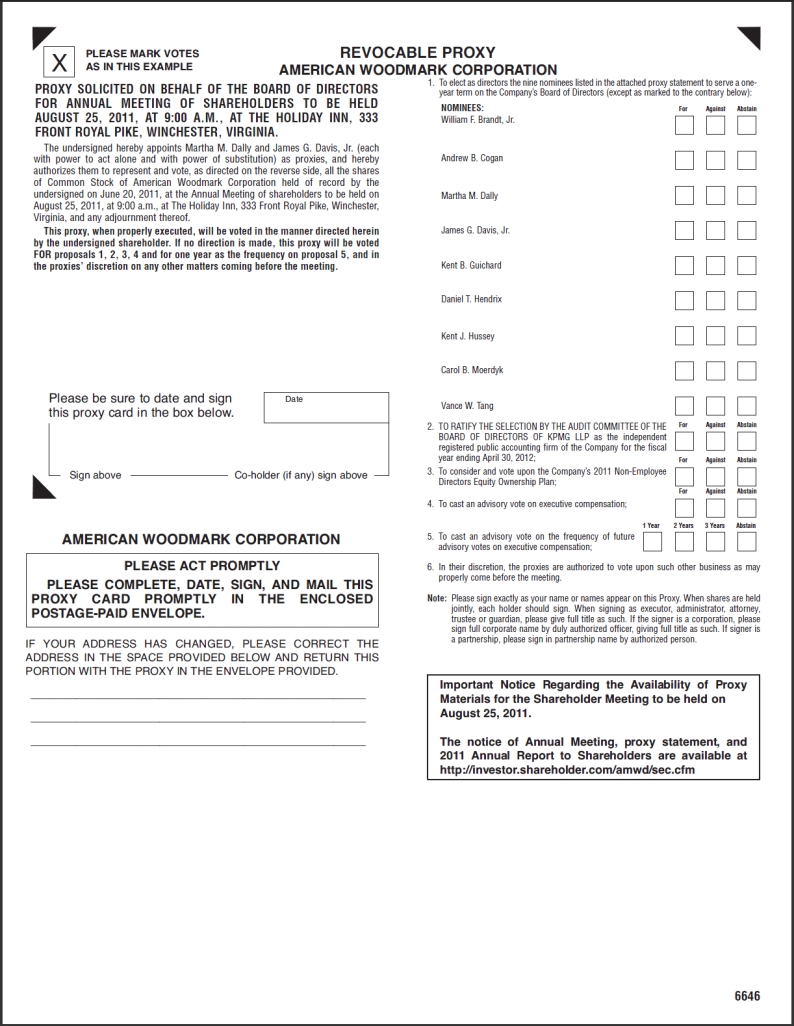

The Annual Meeting of Shareholders (“Annual Meeting”) of American Woodmark Corporation (the “Company”) will be held at the Holiday Inn, 333 Front Royal Pike, Winchester, Virginia, on Thursday, August 26, 2010,25, 2011, at 9:00 a.m., Eastern Daylight Time, for the following purposes:

| | 1. | To elect as directors the nine nominees listed in the attached proxy statement to serve a one-year term on the Company’s Board of Directors,Directors; |

| | 2. | To ratify the selection by the Audit Committee of the Board of Directors of KPMG LLP as the independent registered public accounting firm of the Company for the fiscal year ending April 30, 2011,2012; |

| | 3. | To approve amendments toconsider and vote upon the Company’s Amended and Restated 2004 Stock Incentive Plan for Employees, including an amendment to increase the authorized share reserve by 1,000,000 shares; and2011 Non-Employee Directors Equity Ownership Plan; |

| | 4. | To cast an advisory vote on executive compensation; |

| 5. | To cast an advisory vote on the frequency of future advisory votes on executive compensation; and |

| 6. | To transact such other business as may properly come before the Annual Meeting or any adjournments thereof. |

Only shareholders of record of shares of the Company’s common stock at the close of business on June 21, 2010,20, 2011 will be entitled to vote at the Annual Meeting or any adjournments thereof.

Whether or not you plan to attend the Annual Meeting, please mark, sign and date the enclosed proxy and promptly return it in the enclosed envelope. If for any reason you desire to revoke your proxy, you may do so at any time before it is voted.

All shareholders are cordially invited to attend the Annual Meeting.

| |

| By Order of the Board of Directors |

| |

| Jonathan H. Wolk |

| Secretary |

AMERICAN WOODMARK CORPORATION

Winchester, Virginia 22601

Voting Rights, Procedures and Solicitation

This Proxy Statement, mailed to shareholders of American Woodmark Corporation (the “Company”) on or about July 1, 2010,2011, is furnished in connection with the solicitation of proxies by the Company’s Board of Directors in the accompanying form for use at the Annual Meeting of Shareholders (“the Annual(the “Annual Meeting”) to be held at the Holiday Inn, 333 Front Royal Pike, Winchester, Virginia, on Thursday, August 26, 2010,25, 2011, at 9:00 a.m., Eastern Daylight Time, and at any adjournments thereof. A copy of the annual report of the Company for the fiscal year ended April 30, 2010,2011, is being mailed to you with this Proxy Statement.

In addition to the solicitation of proxies by mail, the Company’s officers and other employees, without additional compensation, may solicit proxies by telephone, facsimile, and personal interview. The Company will bear the cost of all solicitation efforts. The Company also will request brokerage houses and other custodians, nominees, and fiduciaries to forward soliciting material to the beneficial owners of the Company’s common stock held as of the record date by those parties and will reimburse those parties for their expenses in forwarding soliciting material.

Record Date and Voting Rights

On June 21, 2010,20, 2011, the record date for determining the shareholders entitled to receive notice of and to vote at the Annual Meeting, there were 14,222,26214,296,740 shares of common stock of the Company outstanding and entitled to vote. Each such share of common stock entitles the holderowner to one vote.

Revocability and Voting of Proxy

A form of proxy for use at the Annual Meeting and a return envelope for the proxy are enclosed. Any shareholder who provides a proxy may revoke such proxy at any time before it is voted. Proxies may be revoked by: filing with the Secretary of the Company written notice of revocation which bears a later date than the date of the proxy,

duly executing and filing with the Secretary of the Company a later dated proxy relating to the same shares, or

| • | filing with the Secretary of the Company written notice of revocation which bears a later date than the date of the proxy, |

| • | duly executing and filing with the Secretary of the Company a later dated proxy relating to the same shares, or |

| • | attending the Annual Meeting and voting in person. |

attending the Annual Meeting and voting in person.

Votes will be tabulated by one or more inspectors of election. A proxy, if properly executed and not revoked, will be voted as specified by the shareholder. If the shareholder does not specify his or her choice, the shares will be voted FOR the election of the nominees for director named herein, FOR the ratification of KPMG LLP as the independent registered public accounting firm of the Company for fiscal year 2011, FOR the amendments to the Company’s Amended and Restated 2004 Stock Incentive Plan for Employees, and in the proxies’ discretion on any other matters coming before the Annual Meeting.follows:

| • | “FOR” the election of the nine nominees for director named herein; |

| • | “FOR” the ratification of KPMG LLP as the independent registered public accounting firm of the Company for fiscal year 2012; |

| • | “FOR” the adoption of the 2011 Non-Employee Directors Equity Ownership Plan; |

| • | “FOR” the approval of the compensation of the Company’s named executive officers, as disclosed in this Proxy Statement; |

| • | “FOR” an annual advisory vote on compensation of the Company’s named executive officers; and |

| • | In the proxies’ discretion on any other matters coming before the Annual Meeting or any adjournment thereof. |

A majority of the total outstanding shares of the Company entitled to vote on matters to be considered at the Annual Meeting, represented in person or by proxy, constitutes a quorum. If a share is represented for any purpose at the Annual Meeting, it is deemed to be present for quorum purposes and for all other matters as well. Abstentions and shares held of record by a broker or its nominee (“Broker Shares”) that are voted on any matter are included in determining the number of votes present or represented at the Annual Meeting. However, Broker Shares that are not voted on any matter at the Annual Meeting will not be included in determining whether a quorum is present at the meeting.

The Company’s bylaws require that, in uncontested elections, each director receive a majority of the votes cast with respect to that director (the number of shares voted “for” a director nominee must exceed the number of votes cast “against” that nominee). Shareholders may indicate their preference for how frequently the Company should hold advisory votes on executive compensation by choosing among four options, holding the vote every one, two or three years, or abstaining. Actions on all other matters to come before the meeting will be approved if the votes cast “for” thethat action exceed the votes cast “against” it. Abstentions and Broker Shares that are not voted on a particular matter are not considered votes cast and, therefore, will have no effect on the outcome of the election of directors or any other matter.

Participants in the American Woodmark Corporation Investment Savings Stock Ownership Plan will receive a proxy packet from the Company’s transfer agent and registrar, Registrar and Transfer Company, enabling them to voteprovide instructions for voting the shares of the Company’s common stock held in their plan accounts. The Newport Group, the Plan’splan’s administrator, will determine the number of shares beneficially owned by each participant and communicate that information to the transfer agent.1

Each participant’s voting instructions must be properly executed and returned in the envelope provided in order for the participant’s shares to be voted. If a participant does not return voting instructions, then the shares held in the participant’s account will not be voted.

ITEM

1—1 – ELECTION OF DIRECTORS

The Board is currently comprised of nine members, each of whom has been nominated for election by the Company. Unless otherwise specified, the enclosed proxy will be voted for the persons named below to serve until the next Annual Meeting and until their successors are elected and duly qualified. Each of the nominees listed below is presently a director of the Company and with the exception of Mr. Vance W. Tang, was elected by shareholders at the last Annual Meeting for a term expiring at the upcoming Annual Meeting. Mr. Tang was appointed to serve as a director of the Company by the Board effective December 18, 2009. Mr. Tang was recommended to the Nominating and Governance Committee by a third-party search firm.

The Board believes the Company’s directors should possess the highest personal and professional ethics, integrity and values, and be committed to representing the long-term interests of its shareholders. When searching for new directors, the Nominating and Governance Committee considers a candidate’s managerial experience, as well as business judgment, background, integrity, ethics and conflicts of interest. The Nominating and Governance Committee does not have a formal policy with respect to diversity; however, the Board and the Nominating and Governance Committee believe it is essential that the Company’s Board members represent diverse viewpoints. The Nominating and Governance Committee considers issues such as diversity of professional experience, skills, viewpoints, education, gender, race and national origin. In considering candidates for the Board, the Nominating and Governance Committee considers the entirety of each candidate’s credentials in the context of these criteria. With respect to the nomination of continuing directors for re-election, the individual’s contributions to the Board are also considered.

Each nominee listed below has consented to serve as a director, and the Company anticipates all of the nominees named below will be able to serve, if elected. If at the time of the Annual Meeting any nominees are unable or unwilling to serve, then shares represented by properly executed proxies will be voted at the discretion of the persons named therein for such other person or persons as the Board of Directors may designate.

If shareholders do not elect a nominee who is serving as a director, Virginia law provides that the director would continue to serve on the Board as a “holdover director.” Under ourthe Company’s bylaws, each incumbent director submits an advance, contingent, irrevocable offer of resignation that the Board may accept if shareholders do not elect the director at the Annual Meeting. In that situation, the Board’s Nominating and Governance Committee would make a recommendation to the Board about whether to accept or reject the offer of resignation. The Board would act on the Governance Committee’s recommendation within 90 days after the date that the election results were certified and, promptly, would publicly disclose its decision and, if applicable, the rationale for rejecting the resignation within 90 days after the date that the election results were certified.offer of resignation.

Information Regarding Nominees

The names and ages of the Company’s nominees, their principal occupations or employment, and other information regarding each nominee are set forth below. | | | | | | |

Name | | Age | | Principal Occupation(s) During the Last Five Years and Directorship(s) in Public Companies | | Director of

Company

Since |

William F. Brandt, Jr. | | 64 | | Retired; Company Chairman and Chief Executive Officer from 1996 to August 2004. Mr. Brandt has served continuously as director since he founded the Company in 1980. Mr. Brandt previously served as both Chairman and Chief Executive Officer of the Company and remains extremely knowledgeable about the Company and its operations. Mr. Brandt remains the Company’s largest shareholder. | | 1980 |

| | | |

Martha M. Dally | | 59 | | Retired; Vice President Customer Development, Sara Lee Corporation (a public company and manufacturer and marketer of consumer products) from June 2005 to June 2006; Chief Customer Officer, Sara Lee Corporation from June 2003 to July 2005. Ms. Dally’s experience with marketing, business development and customer relationships during her 30-year career in the consumer products industry provides the Board with an important perspective on customer issues and opportunities. | | 1995 |

2

Name | Age | Principal Occupation(s) During the Last Five Years and Directorship(s) in Public Companies | Director of Company Since |

| William F. Brandt, Jr. | 65 | Retired; Company Chairman and Chief Executive Officer from 1996 to August 2004. Mr. Brandt has served continuously as director since he founded the Company in 1980. Mr. Brandt previously served as both Chairman and Chief Executive Officer of the Company and remains extremely knowledgeable about the Company and its operations. Mr. Brandt remains the Company’s largest shareholder. | 1980 |

| Martha M. Dally | 60 | Retired; Vice President Customer Development, Sara Lee Corporation (a public company and manufacturer and marketer of consumer products) from July 2005 to June 2006; Chief Customer Officer, Sara Lee Corporation from July 2003 to July 2005. Ms. Dally’s experience with marketing, business development and customer relationships during her 30-year career in the consumer products industry provides the Board with an important perspective on customer issues and opportunities. | 1995 |

| Kent B. Guichard | 55 | Company Chairman from August 2009 to present and Company President and Chief Executive Officer from August 2007 to present; Company President and Chief Operating Officer from August 2006 to August 2007; Company Executive Vice President and Chief Operating Officer from September 2005 to August 2006; Company Executive Vice President from May 2004 to September 2005; Company Senior Vice President and Chief Financial Officer from 1999 to April 2004; Company Corporate Secretary from November 1997 to February 2005. Mr. Guichard’s 30-year career in industry has been highlighted with leadership roles in finance and operations. Mr. Guichard’s role as the Company’s Chief Executive Officer provides to the Board the Company’s strategic vision and intimate knowledge of its operational performance. | 1997 |

| Kent J. Hussey | 65 | Retired; Chairman, Spectrum Brands, Inc. (a publicly traded manufacturer of consumer products) from August 2009 to June 2010; President and Chief Executive Officer, Spectrum Brands, Inc. from May 2007 to April 2010; Vice Chairman, Spectrum Brands, Inc. from January 2007 to May 2007; President and Chief Operating Officer, Spectrum Brands, Inc. from August 2002 to December 2006; Director, Spectrum Brands, Inc. from October 1996 to June 2010. Spectrum Brands, Inc. emerged from bankruptcy protection in August, 2009. Mr. Hussey’s 40-year career in the consumer products industry has been highlighted with leadership roles in finance and operations. Mr. Hussey’s experience as Chief Executive Officer of a publicly traded manufacturing company that sells products to large retailers provides the Board with an important perspective. | 1999 |

3

| | | | | | |

Name | | Age | | Principal Occupation(s) During the Last Five Years and Directorship(s) in Public Companies | | Director of

Company

Since |

| Kent B. Guichard | | 54 | | Company Chairman from August 2009 to present and Company President and Chief Executive Officer from August 2007 to present; Company President and Chief Operating Officer from August 2006 to August 2007; Company Executive Vice President and Chief Operating Officer from September 2005 to August 2006; Company Executive Vice President from May 2004 to September 2005; Company Senior Vice President and Chief Financial Officer from 1999 to April 2004; Company Corporate Secretary from November 1997 to February 2005. Mr. Guichard’s 30-year career in industry has been highlighted with leadership roles in finance and operations. Mr. Guichard’s role as the Company’s Chief Executive Officer provides to the Board the Company’s strategic vision and intimate knowledge of its operational performance. | | 1997 |

| | | |

| Kent J. Hussey | | 64 | | Retired; Chairman – Spectrum Brands, Inc. (a manufacturer of consumer products) from August 2009 to June 2010; President and Chief Executive Officer - Spectrum Brands, Inc. from May 2007 to April 2010; Vice Chairman, Spectrum Brands, Inc. from January 2007 to May 2007; President and Chief Operating Officer, Spectrum Brands, Inc. from August 2002 to December 2006; Director, Spectrum Brands, Inc. from October 1996 to June 2010. Spectrum Brands emerged from bankruptcy protection in August, 2009. Mr. Hussey’s 40-year career in industry has been highlighted with leadership roles in finance and operations. Mr. Hussey’s experience as a Chief Executive Officer of a publicly traded manufacturing company that sells products to large retailers provides the Board with an important perspective. | | 1999 |

| | | |

| James G. Davis, Jr. | | 51 | | President and Chief Executive Officer, James G. Davis Construction Corporation (a private commercial general contractor) from June 1979 to present; Director, Provident Bankshares Corporation (a public company and financial institution) from October 2006 to July 2009. Mr. Davis’ career in industry has been highlighted with leadership roles in operations. Mr. Davis’ experience as Chief Executive Officer of a construction company provides the Board with an important perspective. | | 2002 |

| | | |

| Daniel T. Hendrix | | 55 | | President and Chief Executive Officer, Interface, Inc. (a public company and manufacturer of industrial carpet products) from July 2001 to present; Director, Interface, Inc. from October 1996 to present; Director, Global Imaging Systems, Inc. (a public technology service company) from January 2003 to May 2007. Mr. Hendrix’ 30-year career in industry has been highlighted with leadership roles in finance and operations. Mr. Hendrix’ experience as a Chief Executive Officer of a publicly traded company in the building supplies industry provides the Board with an important perspective. | | 2005 |

| | | |

| Carol B. Moerdyk | | 60 | | Retired; Senior Vice President, International,OfficeMax Incorporated (a public company and office products retailer, formerly Boise Cascade) from August 2004 to September 2007; Director, Libbey Inc. (a public company and manufacturer of tableware) from 1998 to present. Ms. Moerdyk’s 30-year career in industry has been highlighted with leadership roles in finance and operations. Ms. Moerdyk’s experience as a financial executive enables her to serve as the chair of the Company’s Audit Committee and to provide the Board with a valuable perspective. | | 2005 |

3

| | | | | | |

Name | | Age | | Principal Occupation(s) During the Last Five Years and Directorship(s) in Public Companies | | Director of

Company

Since |

| Andrew B. Cogan | | 47 | | Director, Knoll, Inc. (a public company and manufacturer of furnishings, textiles and fine leathers) from February 1996 to present; Chief Executive Officer, Knoll, Inc., from April 2001 to present; Chief Operating Officer, Knoll, Inc., from 1999 to April 2001. Mr. Cogan’s 25-year career in industry has been highlighted with leadership roles in product development and operations. Mr. Cogan’s experience as a Chief Executive Officer of a publicly traded company provides the Board with a valuable perspective. | | 2009 |

| | | |

| Vance W. Tang | | 43 | | President and Chief Executive Officer of the U.S. subsidiary of KONE OY, (a public company and a leading global provider of elevators and escalators) and Executive Director of KONE Corporation from 2007 to present; Vice President and General Manager, Honeywell Building Control Systems from 2004 to 2007; Board member and Vice President of National Elevator Industry, Inc. (a national trade association). Mr. Tang’s 20-year career in industry has been highlighted with leadership roles in operations. Mr. Tang’s experience as a Chief Executive Officer in the construction industry provides the Board with a valuable perspective. | | 2009 |

Name | Age | Principal Occupation(s) During the Last Five Years and Directorship(s) in Public Companies | Director of Company Since |

| James G. Davis, Jr. | 52 | President and Chief Executive Officer, James G. Davis Construction Corporation (a private commercial general contractor) from June 1979 to present; Director, Provident Bankshares Corporation (a public company and financial institution) from October 2006 to July 2009. Mr. Davis’ career in the construction industry has been highlighted with leadership roles in operations. Mr. Davis’ experience as Chief Executive Officer of a construction company provides the Board with an important perspective. | 2002 |

| Daniel T. Hendrix | 56 | President and Chief Executive Officer, Interface, Inc. (a public company and manufacturer of industrial carpet products) from July 2001 to present; Director, Interface, Inc. from October 1996 to present; Director, Global Imaging Systems, Inc. (a public technology service company) from January 2003 to May 2007. Mr. Hendrix’ 30-year career in the building supplies industry has been highlighted with leadership roles in finance and operations. Mr. Hendrix’ experience as a Chief Executive Officer of a publicly traded company in the building supplies industry provides the Board with an important perspective. | 2005 |

| Carol B. Moerdyk | 61 | Retired; Senior Vice President, International, OfficeMax Incorporated (a public company and office products retailer, formerly Boise Cascade) from August 2004 to September 2007; Director, Libbey, Inc. (a public company and manufacturer of tableware) from 1998 to present. Ms. Moerdyk’s 30-year career in industry has been highlighted with leadership roles in finance and operations. Ms. Moerdyk’s experience as a financial executive enables her to serve as the chair of the Company’s Audit Committee and to provide the Board with a valuable perspective. | 2005 |

| Andrew B. Cogan | 48 | Director, Knoll, Inc. (a public company and manufacturer of furnishings, textiles and fine leathers) from February 1996 to present; Chief Executive Officer, Knoll, Inc. from April 2001 to present; Chief Operating Officer, Knoll, Inc. from 1999 to April 2001. Mr. Cogan’s 25-year career in industry has been highlighted with leadership roles in design and marketing. Mr. Cogan’s experience as a Chief Executive Officer of a publicly traded company provides the Board with a valuable perspective. | 2009 |

| Vance W. Tang | 44 | President and Chief Executive Officer of the U.S. subsidiary of KONE Corporation (a Finnish public company and a leading global provider of elevators and escalators) and Executive Director of KONE Corporation from 2007 to present; Vice President and General Manager, Honeywell Building Control Systems from 2004 to 2007. Mr. Tang’s 20-year career in industry has been highlighted with leadership roles in operations. Mr. Tang’s experience as a Chief Executive Officer in the construction industry provides the Board with a valuable perspective. | 2009 |

Codes of Business Conduct and Ethics

Code of Business Conduct and Ethics.Ethics

The Board of Directors has adopted a Code of Business Conduct and Ethics applicable to all directors, officers, and employees of

American Woodmark Corporation.the Company. This code sets forth important Company policies and procedures in conducting the Company’s business in a legal, ethical, and responsible manner. The Code of Business Conduct and Ethics

also encompasses policies addressing employee conduct, conflicts of interest, insider trading and the protection of confidential information, and requires all employees to respect and obey all applicable laws and regulations when conducting the Company’s business.

Code of Business Conduct and Ethics for the Chief Executive Officer and Senior Financial Officers.Officers

The Board has also adopted an additional Code of Business Conduct and Ethics for the Chief Executive Officer and all Senior Financial Officers, including the Chief Financial Officer, Treasurer, and

Controller.Controller of the Company. This code sets forth Company policies and procedures for ensuring that disclosures in the Company’s financial reports and documents that the Company files or furnishes to the

SECSecurities and Exchange Commission (“SEC”) and in other public communications are full, fair, accurate, timely, and understandable. Additionally, the Chief Executive Officer and Senior Financial Officers are required to report to the Audit Committee any material information that affects financial disclosures, significant deficiencies concerning internal controls, fraud, violations of the Company’s Codes of Business Conduct and Ethics, and violations of securities or other laws or rules and regulations applicable to the operation of the business.

Both of these codes can be found on the

Corporate Governance page of the Company’s web site at

www.americanwoodmark.com.http://investor.shareholder.com/amwd/governance.cfm. Any amendments to, or waivers from any code provisions that apply to the Company’s directors or executive officers, including the Company’s Chief Executive Officer, Chief Financial Officer, Controller, and Treasurer, will be promptly posted on the

Corporate Governance page of the Company’s web site. No amendments or waivers were requested or granted during the fiscal year ended April 30,

2010.2011.

The Company’s Board consists of nine directors, all of whom are subject to annual shareholder elections to one-year terms of service. The Company’s independent directors sit on at least one of the three committees. When former director Mr. Jake Gosa stepped down as Board Chairman in August 2009, committees, which include the Audit Committee, the Compensation Committee and the Governance Committee.

Mr. Guichard

becameserves as both the Company’s Chairman

as well asand its Chief Executive Officer.

The Board believes that currently there are a number of important advantages for the Company to allowhaving the positions of Chairman and Chief Executive Officer to be held by the same person. The Chief Executive Officer is the director most familiar with the Company’s business and industry, and most capable of effectively identifying strategic priorities and leading the discussion and execution of strategy.

4

Independent directors and management have different perspectives and roles in strategy development. The Company’s independent directors bring experience, oversight and expertise from outside the Company and its industry, while the Chief Executive Officer brings Company-specific experience and expertise. The Board believes that the combined role of Chairman and Chief Executive Officer promotes strategy development and execution, and facilitates information flow between Managementmanagement and the Board, which are essential to effective governance.

The Company’s independent directors meet in regularly scheduled executive sessions at each of the Company’s Board meetings, without management present. During fiscal year

2010,2011, the independent directors met four times to discuss certain Board policies, processes and practices, the performance and compensation of the Company’s Chief Executive Officer, management succession and other matters relating to the Company and the functioning of the Board.

Risk Management Oversight

The Board, both directly and through its committees, has an active role as a whole and also at the committee level, in overseeing management of the Company’s risks. The Board regularly reviews information concerning the Company’s operations, liquidity and competitive position and personnel, as well as the risks associated with each. The Company’s Compensation Committee is responsible for overseeing the Company’s management of its risks relating to the Company’s executive and long-term compensation plans.plans and risks related to employee compensation in general. The Audit Committee oversees the Company’s management of its risks pertaining to internal controls, adherence to generally accepted accounting principles and financial reporting. The Nominating and Governance Committee oversees the Company’s management of its risks pertaining to potential conflicts of interest and independence of board members. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board of Directors is regularly informed through committee reports about such risks.

The Board of Directors of

American Woodmark Corporationthe Company is composed of a majority of directors who are independent directors as defined under the NASDAQ Marketplace Rules. The

Company’sBoard’s Audit Committee members

also meet additional independence requirements pursuant to the NASDAQ Marketplace Rules and SEC rules.

To be independent under the NASDAQ Marketplace Rules, the Board must determine that a director has no relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The NASDAQ Marketplace Rules specify certain persons who cannot be considered independent. The Board reviews the independence of all directors at least annually.

Based upon this review, the Board affirmatively determined that seven of its nine directors are independent as defined by the NASDAQ Marketplace Rules. The independent directors are: Mr. Cogan, Ms. Dally, Mr. Davis, Mr. Hendrix, Mr. Hussey, Ms. Moerdyk, and Mr. Tang, each of whom is standing for

electionre-election at the Annual Meeting. In addition, all of the members presiding on the Audit Committee,

the Compensation Committee, and the

Nominating and Governance Committee are independent. The members of the Audit Committee

also meet the additional independence requirements applicable to them under the NASDAQ Marketplace Rules and SEC rules.

Communicating Concerns to the Board of Directors

The Audit Committee and the

independent non-management directors have established procedures to enable any shareholder or employee who has a concern about the Company’s conduct or policies, or any employee who has a concern about the Company’s accounting, internal accounting controls or auditing matters, to communicate that concern directly to the Board, to the independent directors, or to the Audit Committee. Such communications may be confidential or anonymous. Such communications may be submitted in writing by sending a

letter, along with a self-addressed, stamped

letterenvelope to:

American Woodmark Corporation Winchester, Virginia 22601

The

Company’s Corporate Secretary will review all such written correspondence and forward to the Audit Committee a summary of all correspondence received. The

Audit Committee will review this information and determine a course of action as appropriate based on the information received.

5

The

Audit Committee reviews and regularly provides the Board of Directors with a summary of all communications received from shareholders and employees and the actions taken or recommended to be taken if an action requires approval of the full Board as a result of such communications. Directors may, at any time, review a log of all correspondence received by the Company which is addressed to

the Board, members of the Board

or the Audit Committee and may request copies of any such correspondence.

Board of Directors and Committees

The Company’s Board of Directors presently consists of nine directors. The Board held four meetings during the fiscal year ended April 30,

2010.2011. All of the directors attended at least

75 percent75% of the total number of

boardBoard meetings and meetings of all committees of the Board held during periods when they were members of the Board or such

committees.committees, with the exception of Mr. Hendrix (Chair of the Compensation Committee), who attended 50% of the Board meetings and 100% of the Compensation Committee meetings. The Board of Directors believes that attendance at

American Woodmark Corporation’sthe Company’s Annual Meeting

of Shareholders demonstrates a commitment to the Company, responsibility and accountability to the shareholders, and support of management and employees. Therefore, it is a policy of the Board that all members attend the Annual Meeting of Shareholders. All members of the Board attended last year’s Annual

Meeting of Shareholders.Meeting.

The Company’s bylaws specifically provideallow for anthe Board to create one or more committees and to appoint members of the Board to serve on them. Under such authority, the Board created the Audit Committee, the Compensation Committee, and a Nominating andthe Governance Committee each of which must be composed solely of independent directors. The Board hasand, appointed individuals from among its independent members to serve on these three committees. Each committee operates under a written charter adopted by the Board, as amended from time to time. On an annual basis, each Committeecommittee reviews and reassesses the adequacy of its Committee Charter.committee charter. Committees are scheduled to meet quarterly and may hold special meetings as necessary. These committees report regularly to the Board of Directors with respect to their fulfillment of the responsibilities and duties outlined in their respective charters. These charters can be found on the Corporate Governance page of the Company’s web site at www.americanwoodmark.com.http://investor.shareholder.com/amwd/governance.cfm.

The Audit Committee consists of Ms. Moerdyk, who chairs the Committee, Mr. Davis,

Mr. Hussey and Mr.

Hussey.Cogan. All members have been determined by the Board of Directors to be “independent” as defined under the NASDAQ Marketplace Rules and SEC rules. The Board of Directors has determined that all of the current members of the Audit Committee are “audit committee financial experts” as defined under SEC rules.

Purpose and Duties.The Audit Committee

is primarily concerned withprovides oversight for the integrity of the Company’s financial statements, the Company’s compliance with legal and regulatory requirements, the independence and qualifications of the Company’s independent registered public accounting firm, the performance of the internal audit function and independent registered public accounting firm, and the adequacy and competency of the Company’s finance and accounting staff.

The Audit Committee’s duties include but are not limited to: (1) selecting and overseeing the performance of the Company’s independent registered public accounting firm, (2) reviewing the scope of the audits to be conducted by them, as well as the results of their audits, (3) overseeing the Company’s financial reporting activities, including the Company’s

annual report,financial statements included in the Company’s Annual Report on Form 10-K, and the accounting standards and principles that are followed; (4) approving audit and non-audit services provided to the Company by the Company’s independent registered public accounting firm, (5) reviewing the organization and scope of the Company’s internal audit function and internal controls, (6) reviewing and approving or ratifying transactions with related persons required to be disclosed under SEC rules, and (7) conducting other reviews relating to compliance by employees with Company policies and applicable laws.

The Audit Committee met six times during fiscal year

2010.2011. The Audit Committee is governed by a written charter approved by the Board of Directors, which can be viewed on the

Corporate Governance page of the Company’s web site at

www.americanwoodmark.com.http://investor.shareholder.com/amwd/governance/cfm. The Report of the Audit Committee is contained on page 31.

The Compensation Committee is composed of Mr. Hendrix, who chairs the Committee,

Mr. Cogan, Ms. Dally and Mr. Tang. All members have been determined by the Board of Directors to be “independent” as defined under the NASDAQ Marketplace Rules.

Purpose and Duties.The Compensation Committee is primarily concerned with designing and managing competitive compensation programs to facilitate the attraction and retention of talented senior executives and directors. The activities of

thisthe Compensation Committee include reviewing, evaluating, and approving senior executive compensation plans and evaluating and recommending director compensation plans for approval by the Board. The

Compensation Committee also provides oversight for all of the Company’s employee benefit plans. The

Compensation Committee delegates certain aspects of implementation and day-to-day management of compensation administration to officers of the Company.

6

The Compensation Committee’s duties include but are not limited to: (1) reviewing, evaluating, and approving corporate goals and objectives relevant to the Chief Executive Officer and other senior executive officer compensation, (2) evaluating the Chief Executive Officer’s and other senior executive officers’ performance in light of those goals and objectives, (3) determining and approving the Chief Executive Officer’s and other senior

executive officers’ compensation levels based on this evaluation, and (4) evaluation and determination of the compensation of the Company’s senior executives, and (5) oversight ofoverseeing the compensation and benefit plans, policies, and programs of the Company. The Compensation Committee determines the Chief Executive Officer’s compensation after reviewing his performance with the independent directors of the Board and without members of

Managementmanagement or the non-independent directors being present, and shares this information with the full Board. The Compensation Committee determines the compensation of the other senior executives after considering the recommendation from the Chief Executive Officer. The Compensation Committee does not delegate its authority with regard to executive compensation decisions.

The Compensation Committee administers and approves awards

granted under

the Company’s 1996 and 1999 Stock Option Plans for Employees, the Amended and Restated 2004 Stock Incentive Plan for Employees, and

will be responsible for administering and approving awards under the Company’s

Shareholder Value2011 Non-Employee Director Equity Ownership Plan,

for Employees.if the plan is approved by shareholders as proposed herein.

The Compensation Committee met three times during fiscal year

2010.2011. The Compensation Committee’s charter can be viewed on the

Corporate Governance page of the Company’s web site at

www.americanwoodmark.com.http://investor.shareholder.com/amwd/governance.cfm. Additional information on the Company’s philosophy and policies pertaining to executive compensation are addressed in the Compensation Discussion

&and Analysis beginning on page 9. The Report of the Compensation Committee is contained on page 26.

Nominating and

The

Nominating and Governance Committee is composed of Ms. Dally, who chairs the Committee,

Mr. Hussey and Ms. Moerdyk.

BothAll members have been determined by the Board of Directors to be “independent” as defined under the NASDAQ Marketplace Rules.

The Committee’s charter requires that it be comprised of a minimum of three independent directors. The Company plans on adding a new member to the Committee during its fiscal year 2011.

Purpose and Duties.Duties. The

Nominating and Governance Committee is responsible for identifying and recommending to the Board new director nominees for the Board, recommending directors for appointment to committees and chairs, and ensuring that the size, composition, and practices of the Board best serve the Company and its shareholders. From time to time, the Committee may engage an independent firm to assist in identifying potential candidates.

In evaluating candidates for election to the Board, the

Nominating and Governance Committee will assess the candidate’s character and professional ethics, judgment, business experience, independence, understanding of the Company’s or other related industries, and other factors deemed pertinent in light of the current needs of the Board. Specific qualities and skills established by the Committee for directors, which are included in the

Nominating and Governance Committee

Charter,charter, include:

each candidate will be recommended without regard to gender, race, age religion or national origin;

each candidate must be an individual that has consistently demonstrated the highest character and integrity;

| • | each candidate will be recommended without regard to gender, race, age, religion or national origin; |

| • | each candidate must be an individual that has consistently demonstrated the highest character and integrity; |

| • | each candidate must have demonstrated professional and managerial proficiency, an openness to new and unfamiliar experiences and the ability to work in a team environment; |

| • | each candidate must be free of any conflicts of interest which would violate applicable law or regulation or interfere with the proper performance of the responsibilities of a director; |

| • | each candidate should possess substantial and significant experience which would be of particular relevance to the Company and its shareholders in the performance of the duties of a director; and |

| • | each candidate must demonstrate commitment to the responsibilities of being a director, including the investment of the time, energy and focus required to carry out the duties of a director. |

each candidate must have demonstrated professional and managerial proficiency, an openness to new and unfamiliar experiences and the ability to work in a team environment;

each candidate must be free of any conflicts of interest which would violate applicable law or regulation or interfere with the proper performance of the responsibilities of a director;

8

each candidate should possess substantial and significant experience which would be of particular relevance to the Company and its shareholders in the performance of the duties of a director; and

each candidate must demonstrate commitment to the responsibilities of being a director, including the investment of the time, energy and focus required to carry out the duties of a director.

7

The

Nominating and Governance Committee’s responsibilities also include, but are not limited to: (1)

regular assessment ofregularly assessing the effectiveness of the Board; (2)

annualannually reviewing the performance

reviews of each director; (3) determining whether any director conflicts of interest exist; (4) reviewing any director related party transactions; and (5) periodically reviewing the Company’s corporate governance policies. The

Nominating and Governance Committee met

fivethree times during fiscal year

2010.2011. The

Governance Committee’s charter can be viewed on the

Corporate Governance page of the Company’s web site at

www.americanwoodmark.com.http://investor.shareholder.com/amwd/governance.cfm.

Procedures for Shareholder

RecommendationsNominations of

Director NomineesDirectors

The

Nominating and Governance Committee will consider a director

candidate recommendednominated by a shareholder

of record for the fiscal year

20112012 Annual Meeting if the

recommendationnomination is submitted in writing to the Secretary of the Company in accordance with the Company’s bylaws and is received in the Company’s principal executive offices on or before April 28,

2011.2012. The

recommendationnomination must include

the name and address of the director nominee and a description of the

candidate’sdirector nominee’s qualifications for serving as a director and the following information:

the name and address of the shareholder making the recommendation;

a representation that the shareholder is, and will remain, a record holder of the Company’s common stock entitled to vote at the meeting and, if necessary, would appear in person or by proxy at the meeting to nominate the person or persons recommended;

| • | the name and address of the shareholder making the nomination; |

| • | a representation that the shareholder is a record holder of the Company’s common stock entitled to vote at the meeting and, if necessary, would appear in person or by proxy at the meeting to nominate the person or persons specified in the nomination; |

| • | a description of all arrangements or understandings between the shareholder and the nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the shareholder; |

| • | such other information regarding the director nominee as would be required to be included in a proxy statement filed under the proxy rules of the SEC, if the director nominee were to be nominated by the Board of Directors; |

| • | information regarding the director nominee’s independence as defined by applicable NASDAQ listing standards; and |

| • | the consent of the director nominee to serve as a director of the Company if nominated and elected. |

a description of all arrangements or understandings between the shareholder and the nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the shareholder;

information regarding the director candidate that would be required to be included in a proxy statement filed under the proxy rules of the Securities and Exchange Commission, if the candidate were to be nominated by the Board of Directors;

information regarding the director candidate’s independence as defined by applicable NASDAQ listing standards; and

the consent of the director candidate to serve as a director of the Company if nominated and elected.

The Nominating and Governance Committee may subsequently request additional information regarding the candidatedirector nominee or the shareholder making the recommendation. Recommendationsnomination. Nominations by shareholders made in accordance with these procedures will receive due consideration by the Nominating and Governance Committee. However, the Chair of the Governance Committee may refuse to acknowledge the nomination of any person not made in compliance with these procedures. The Nominating and Governance Committee also considers candidatesdirector nominees recommended by current members of the Board of Directors and members of management. From time to time, the Governance Committee may engage an independent firm to assist in identifying potential candidates.director nominees. The Committee engaged an independent executive search firm for this purpose during fiscal year 2010. TheGovernance Committee evaluates all candidatesdirector nominees in the same manner regardless of the source of the recommendation.

8

Compensation Discussion and Analysis

The Company’s Compensation Program Goal

The goal of the Company’s compensation program, as administered by the Compensation Committee, is to facilitate the creation of long-term value for its shareholders by attracting, motivating, and retaining qualified senior management. To this end, the Company has designed and administered the Company’s compensation program to appropriately reward its executives for sustained financial and operating performance, to align their interests with those of the Company’s shareholders, and to encourage them to remain with the Company for long and productive

careers. To achieve alignment with shareholder interests, the Company’s compensation program provides significant, but appropriate, rewards for outstanding performance, as well as clear financial consequences for underperformance. The majority of the Company’s senior executives’ compensation is “at risk” in the form of annual and long-term incentive awards that are paid, if at all, based upon Company and individual performance. While a significant portion of compensation may fluctuate with annual results, the total program is structured to emphasize long-term performance and sustained growth in shareholder value.

Key Considerations in Setting Pay

The following is a summary of the key considerations affecting the determination of compensation by the Compensation Committee for the Company’s named executive officers. The Company’s named executive officers

includefor fiscal year 2011 were Mr. Guichard, Chairman and Chief Executive Officer, S. Cary Dunston, Senior Vice President of Manufacturing and Logistics,

and Jonathan H. Wolk,

Senior Vice President and Chief Financial

Officer. Mr. Gosa was the Company’s ChairmanOfficer, and

a named executive officer until he stepped down from the Company’s Board in August 2009.Bradley S. Boyer, Senior Vice President of Remodeling Sales and Marketing.

Performance-based Compensation. Every employee in the Company has an opportunity to earn an annual bonus, most of which is based upon the Company’s attainment of its net income and free cash flow goals, and other operational performance goals. Free cash flow was added as a Company-wide goal during fiscal year 2010, given the importance of this metric during the difficult economic environment that has adversely impacted the Company’s industry since 2006.

The Company defines “free cash flow” as the Company’s net cash provided (used) by operating activities less net cash used in investing activities. Bonuses are only payable to employees if the Company earns net income or free cash flow in excess of specified threshold levels during its fiscal year. The majority of the targeted total compensation for the Company’s named executive officers is performance-based, to achieve alignment with shareholder interests. The Company strives to establish challenging Company-wide targets that are appropriate given the expected level of performance, as well as current and anticipated market conditions.

Balance of Future Pay Opportunity versus Current Pay Opportunity. The Compensation Committee strives to provide an optimal balance between current and long-term compensation, and cash versus equity compensation for the Company’s executive officers. Current compensation is paid in cash in the form of a base salary and an annual bonus, primarily as a reward for recent performance, while long-term compensation is primarily equity-based, to encourage the Company’s executive officers to deliver excellent results over a longer period of time and to serve as a retention tool. The Compensation Committee has targeted the mix of performance-based compensation for the Company’s senior executive officers to be an equal amount of current year bonus and long-term compensation.

Providing shareholders with a high level of return on their investment is an important objective of the Company, the Board, and the Compensation Committee. As a result, performance that rewards the Company’s shareholders factors prominently in the Compensation Committee’s decisions about the type and amount of long-term compensation paid to the Company’s executive officers.

Discretionary Nature of Compensation Programs. The Compensation Committee does not use formulas in determining the amount and mix of compensation to be paid to the Company’s executives. The Compensation Committee believes that using only quantitative performance measures would not create the appropriate balance of incentives to build long-term shareholder value. The Compensation Committee uses a broad range of quantitative and qualitative factors to determine compensation. Quantitative factors are determined annually based upon the Company’s overall goals and objectives. In general, qualitative factors include the executives’ ability to lead the Company’s attainment of its CITE principles of customer satisfaction, integrity, teamwork and excellence. Additional qualitative factors considered by the Compensation Committee include the executives’ contribution to achieving the Company’s overall vision, the evaluation of the executives’ performance against their stated objectives, their experience, skill sets and the breadth, and scope of their responsibilities.

9

Significance of Company Results. The Compensation Committee believes that the named executive officers’ contributions to the Company’s overall performance as part of the Company Leadership Team are more important than their individual performance. Accordingly, all of the annual bonus opportunity for Mr.Messrs. Guichard, Dunston, and formerly for Mr. Gosa,Wolk, and 70 percent50% of the annual bonus opportunity for Messrs. Wolk and DunstonMr. Boyer is dependent upon the Company’s performance in relation to its net income and

free cash flow goals. The remainder of the annual cash bonus opportunity for Messrs. Wolk and DunstonMr. Boyer is based upon the achievement of their respective organizational sales and individual goals; however no payment is made relating to these individualcost performance goals unless the Company generates net income.goals.

Consideration of Compensation Risk. The Company’s compensation programs are discretionary, balanced and focused on the long-term. Under this structure, the highest amount of compensation can be achieved through consistent superior performance over sustained periods of time. This provides strong incentives to manage the Company for the long term, while avoiding excessive risk in the short term. GoalsThe elements of the Company’s variable compensation program are balanced among current cash payments and objectives reflectequity awards. The Company uses a balanced mix of quantitative and qualitative performance measures to assess achievement for its performance-based restricted stock unit awards to avoid placing excessive weight on a single performance measure. Likewise, the elements of compensation are balanced among current cash payments and equity awards. The Company has also adopted stock ownership guidelines under which its named executive officers are expected to hold a significant amount of Company stock on an ongoing basis, which the Compensation Committee believes helps mitigate compensation-related risk by focusing the officers’ attention and efforts on the long-term stock performance of the Company.

Use of Compensation Consultants and Peer Group Data. The Company, at the direction of the Compensation Committee, retains an independent compensation consultant every three to four years to assist the

Compensation Committee by collecting compensation data regarding peer group companies, which is used by the

Compensation Committee in reviewing and establishing executive compensation guidelines. The

Compensation Committee considers this data, among other factors, when it determines the components and amounts of total compensation that are appropriate for the Company’s named executive officers. In its most recent compensation review in 2008, the Company retained Mercer to develop and update the Company’s Competitive Peer Group for use in the evaluation of the Company’s compensation practices, to establish competitive compensation levels, and

to assess the Company’s executive compensation program. Mercer performs no other services for the Company other than those described in this section.

The Company’s

Competitive Peer Group was selected by Mercer and consists primarily of similar-sized companies in the furniture and building products industries that may compete with the Company for executive talent and which investors may consider as investment alternatives to the Company. For purposes of Mercer’s 2008 analysis, the

competitiveCompany’s Competitive Peer Group included: American Biltrite, Inc., Ameron International Corporation, Associated Materials, LLC, Dayton Superior Corporation, Ethan Allen Interiors Inc., Flexsteel Industries, Inc., Hooker Furniture Corporation, Kimball International, Inc., Knoll, Inc., Patrick Industries, Inc., School Specialty, Inc., Select Comfort Corporation, Simpson Manufacturing Co., Inc., and Tempur-Pedic International Inc.

In its 2008 update, Mercer analyzed competitive compensation packages using proxy information from the

companies included as part of the Company’s Competitive Peer Group,

companies, and also considered data compiled from published surveys of executive compensation for comparably-sized companies within the durable goods manufacturing sector. Mercer’s findings were that both the Company’s targeted annual cash compensation and long-term compensation levels fell within a range between the 50th percentile to the 75th percentile of median market compensation for the

companies included as part of the Company’s Competitive Peer Group

companies and for comparably-sized companies in comparable industries. These findings were consistent with the Compensation Committee’s compensation objective.

10

The compensation program for executive officers for fiscal

2010year 2011 consisted of the following elements:

Elements available to substantially all salaried employees:

annual performance-based cash bonus;

| • | base salary; |

| • | annual performance-based cash bonus; |

| • | annual employee profit sharing; and |

| • | retirement and health and welfare benefits. |

annual employee profit sharing; and

retirement and health and welfare benefits.

Elements available to the Company’s key managers and selected employees:

long-term incentive awards (restricted stock units only, or restricted stock units plus stock options).

Elements available only to some named executive officers: supplementary employee retirement plan; and

other benefits.

| • | supplementary employee retirement plan; and |

| • | other benefits. |

These compensation elements are described below:

Base Salary.Base salary is intended to compensate the Company’s executives for:

the scope of their responsibilities;

the complexity of the tasks associated with their position within the Company;

| • | the scope of their responsibilities; |

| • | the complexity of the tasks associated with their position within the Company; |

| • | their skill set; and |

| • | their performance. |

Base salaries for all executives have been competitively established based on salaries paid for like positions in comparably-sized companies. The companies used for comparison of base salaries may include additional companies from those used in the competitiveCompany’s Competitive Peer Group where other competitive factors or local market conditions warrant. These salaries are obtained by Managementmanagement periodically and reviewed by the Compensation Committee to assure continued competitiveness and are adjusted when necessary. Based upon national surveys available to the Compensation Committee and information provided by Mercer, the Compensation Committee believes executive management, both individually and as a group, have base salaries of approximately the average market rate for comparably-sized companies.

Annual Cash Bonus. Annual cash bonus incentive awards are provided as an incentive to executives to achieve the Company’s annual financial goals, and reflect the Compensation Committee’s belief that a significant portion of the annual compensation of senior executives and other key employees should be contingent upon the financial performance of the Company. Annual bonus levels are established as a percentage of base salary. Jobs with greater spans of control and impact upon the Company’s results have higher bonus percentages. For fiscal year

2010,2011, Mr. Guichard was eligible for a maximum potential bonus opportunity equal to 150% of his base salary; Messrs. Dunston and Wolk were eligible for maximum potential bonus opportunities equal to 100% of their respective base

salaries,salaries; and Mr.

GosaBoyer was

not eligible for a

bonus.maximum potential bonus opportunity equal to 70% of his base salary.11

Most key managers and senior executives have two components to their annual bonus: one component that is tied to the Company’s performance for the fiscal year, and one component that is tied to individual performance. For fiscal year

2010,2011, net income and free cash flow were utilized to measure Company performance for the purpose of measuring the Company performance bonus component for nearly every employee in the Company, due to their ease of understanding as simple, consistent and important indicators of the Company’s annual performance. Because both performance measures were deemed to be of equal importance, each performance measure carried a weighting of 50% in evaluating Company-wide performance for fiscal year

2010.2011. Individual performance is assessed by each employee’s manager based on agreed-upon goals established at the onset of the fiscal year. No portion of an employee’s individual goal bonus is paid unless the Company generates positive net income.

All of the annual cash bonus opportunity for

Mr.Messrs. Guichard,

representing 150 percent of his base salaryDunston and Wolk was dependent upon the Company’s performance with respect to the net income and free cash flow performance measures. The annual

cash bonus opportunity for

Messrs. Wolk and DunstonMr. Boyer represented

100 percent70% of

their respectivehis base

salaries,salary, of which

70 percent50% was dependent

uponon the Company’s performance with respect to its net income and free cash flow performance measures, and

30 percent50% was dependent upon

the achievement of

their respective organizational

sales performance and

individualcost management goals.

Company Goals. On an annual basis, the Compensation Committee establishes bonus goals for Company performance based upon a variety of factors including progress achieved towards critical elements of the Company’s

long term strategy, prior year performance, and the external economic environment. As a result, Company-wide performance targets vary from fiscal year to fiscal year. The annual performance goals for each of the

fiscal years listed below represented the expected range of Company net income and free cash flow across

the following three levels of performance:

“Threshold” representing the minimum level of achievement in order to qualify for payment;

“Target” representing performance consistent with demanding expectations to qualify for a payout of 60% of the maximum; and

| • | “Threshold” representing the minimum level of achievement in order to qualify for payment; |

| • | “Target” representing performance consistent with demanding expectations to qualify for a payout of 60% of the maximum; and |

| • | “Superior” representing outstanding performance against demanding expectations to achieve 100% of the maximum. |

“Superior” representing outstanding performance against demanding expectations to achieve 100% of the maximum.

Company performance falling between each performance level results in an interpolated percentage payout based upon a predetermined scale. No annual bonuses are paid if the Company’s performance is below the predetermined threshold level for both performance measures.

Company performance targets are set sufficiently high to require excellent performance. In the last

nineten years, the Company has achieved superior performance one time, and achieved target performance four times. Annual performance goals for Company performance at the threshold, target and superior performance levels for fiscal year

2010,2011, as well as the actual net income and free cash flow achieved, are presented in the table below (dollar amounts in millions).

The actual net income listed below for fiscal year 2010 represents the reported amount of the Company’s net income (loss), excluding restructuring charges net of income tax benefit of $1.8 million. For comparison purposes, annual net income

and free cash flow goals at the threshold, target and superior performance levels are presented for fiscal

years 2008year 2010 and

net income for fiscal year 2009, as well (free cash flow was not a Company performance measure until fiscal year 2010). The actual net income listed below for fiscal

yearyears 2009

and 2010 excludes restructuring charges net of income tax benefit of $6.0

million. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net Income | | | Free Cash Flow | |

Fiscal Year | | Net Income Goals | | Actual | | | Free Cash Flow Goals | | | Actual | |

| | Threshold | | Target | | Superior | | | Threshold | | | Target | | | Superior | | |

2008 | | $ | 22.0 | | $ | 30.0 | | $ | 36.0 | | $ | 4.3 | | | | | | | | | | | | | | | | | |

2009 | | $ | 0.0 | | $ | 10.0 | | $ | 20.0 | | $ | 2.8 | | | | | | | | | | | | | | | | | |

2010 | | $ | 0.0 | | $ | 10.0 | | $ | 20.0 | | $ | (20.6 | ) | | $ | (20.9 | ) | | $ | (12.0 | ) | | $ | (6.8 | ) | | $ | (10.2 | ) |

12

million and $1.8 million, respectively.

| | | Net Income | | | Free Cash Flow | |

| Fiscal | | Net Income Goals | | | Actual | | | Free Cash Flow Goals | | | Actual | |

| Year | | Threshold | | | Target | | | Superior | | | | | | Threshold | | | Target | | | Superior | | | | |

| 2009 | | $ | 0.0 | | | $ | 10.0 | | | $ | 20.0 | | | $ | 2.8 | | | | | | | | | | | | | |

| 2010 | | $ | 0.0 | | | $ | 10.0 | | | $ | 20.0 | | | $ | (20.6 | ) | | $ | (20.9 | ) | | $ | (12.0 | ) | | $ | (6.8 | ) | | $ | (10.2 | ) |

| 2011 | | $ | 0.0 | | | $ | 10.0 | | | $ | 20.0 | | | $ | (20.0 | ) | | $ | 6.0 | | | $ | 12.0 | | | $ | 16.0 | | | $ | 7.7 | |

Actual performance for fiscal year

20102011 resulted in a combined Company performance percentage based on the weightings of the performance measures and the predetermined bonus scale of approximately

37%6.4%. Accordingly, Mr. Guichard earned an annual bonus

pertaining to Company performance during fiscal year

20102011 of approximately

56% (37%9.6% (6.4% of 150%) of his base salary at year-end. Bonuses for Messrs. Dunston and Wolk

pertaining to Company performance for fiscal year 2010 represented approximately

26% (37%6.4% (6.4% of

70%100%) of their respective base salaries at year-end.

Individual Goals. Messrs. Dunston and Wolk were eligible The bonus for Mr. Boyer pertaining to have a portionCompany performance represented approximately 2.2% (6.4% of their35%) of his base salary at year-end.

Organizational Sales Goals. Half of Mr. Boyer’s annual cash bonus for fiscal year 20102011 was determined based upon the achievement of organizational sales and cost performance goals. Management develops a budget which is presented to the Board. The Board reviews and approves the budget. The organizational sales and cost performance goals that Mr. Boyer is expected to achieve are developed based on the achievementbudget. Mr. Boyer’s organizational sales goals were related to both attainment of individual performance goals.Mr. Guichard develops the individual objectives that both executives are expected to achieve, and against which their performance is assessed. These objectives and performance assessments are reviewed and approved by the Compensation Committee each year. When the Company has generated net income, the Compensation Committee makes a determination of the proportion of the 30% individual performance bonus earned by each individual, in its discretion, with the assistance of Mr. Guichard, based on a combination of quantitative and qualitative measurements developed to assess achievement. No particular weighting is given to any one individual performance goal. In assessing each executive’s performance, the Compensation Committee considers the entirety of each executive’s performance.

For fiscal year 2010, Mr. Dunston’s individual goals included objectives relating to operational performance including safety, quality, deliveryremodeling sales levels and cost of sales.

Mr. Boyer achieved his organizational sales and

cost performance goals according to the

overall effectivenessCompany’s expectations, and therefore earned the portion of

the Company’s supply chain.his bonus attributable to these goals at “target”. The bonus for Mr.

Wolk’s individual goals for fiscal year 2010 included objectives relatingBoyer pertaining to

operational and business support, managementhis organization sales performance represented approximately 21% (60% of

the Company’s cash flow and financial flexibility, controllership and management information systems.Because there was no net income in fiscal year 2010, Messrs. Dunston and Wolk did not receive any annual bonus payouts with respect to their individual goals.

35%) of his base salary at year-end.

Long-Term Incentive Awards. The Compensation Committee has established long-term incentive awards for the Company’s executives and key managers with the objective of advancing the longer-term interests of the Company and its shareholders by directly aligning executive compensation with increases in the Company’s stock price. These awards compliment cash incentives tied to annual performance by providing incentives for executives

to increase shareholder value over time. The Company’s long-term incentive compensation has historically utilizedprogram utilizes two types of awards: stock options and shareholder value units. During fiscal year 2010, the Compensation Committee acted upon a recommendation from Mercer and issued restricted stock units (RSUs) in place of shareholder value units for Messrs. Guichard, Dunston(“RSUs”) and Wolk.stock options. Both stock options and RSUs are intended to focus the attention of executives on the achievement of the Company’s long-term performance objectives, to align executive management’s interests with those of shareholders, and to facilitate executives’ accumulation of sustained ownership of Company stock.

Consistent with previous years, the Company awarded its long-term incentive awards to its executives following its annual earnings release in June, and all stock options issued included a strike price equal to the closing price of the Company’s stock on the third business day following this earnings release. All long-term incentive awards were approved by the Compensation Committee.

In line with recommendations from Mercer, the Company’s named executive officers are targeted to receive long-term incentive awards valued at approximately

150 percent150% of base salary for Mr. Guichard and

100 percent100% for Messrs.

WolkDunston and

Dunston.Wolk. The long-term incentive award for Mr.

Gosa did not receive a long-term awardBoyer during fiscal year

2010.2011 was valued at approximately 65% of base salary due to his becoming a named executive officer mid-year. The Compensation Committee expects to increase Mr. Boyer’s award for fiscal year 2012 to 100% of his base salary. The relative value of stock option awards compared with RSU awards made to the named executive officers was approximately even.

Stock Options.Non-statutory stock options were granted to certain senior executives of the Company (including Messrs. Guichard, Dunston,

Wolk and

Wolk)Boyer) on the third business day after the Company’s announcement of its annual results in June

2009.2010. All stock options have exercise prices equal to the closing price of the Company’s stock upon the date of grant, have ten-year lives and vest ratably over the initial three years of the grant. Stock options only result in value realized by the Company’s employees to the extent that the price of Company stock on the date of exercise exceeds the strike price, and thus are an effective compensation element only if the stock price grows over the term of the award. The Compensation Committee believes that stock options are a motivational tool for the Company’s senior executives, and also serve as a retention incentive. The Company has never backdated or

changed the terms ofrepriced its stock option grants.

13

Shareholder Value Units. Prior to fiscal year 2010, the Company granted Shareholder Value Units (SVUs) to its named executive officers and key managers. Each of these units entitled the recipient to receive a cash payment of $500 per unit if the Company’s total shareholder return (TSR) over a three-year performance period equaled the return of the Russell 2000 Index, with higher potential payments if the Company’s TSR exceeded the Russell 2000 Index return and no payments if the Company’s TSR was below the Russell 2000 Index return for the relevant performance period. The maximum potential payment was $3000 per unit, if the Company’s TSR exceeded the Russell 2000 Index return by 20% or more. If the Company’s TSR exceeded the Russell 2000 Index return by less than 20%, then the officer was entitled to a cash payment between $500 and $3,000 per unit, based upon a predetermined scale.The last SVUs were granted in fiscal year 2009; the Company did not grant any SVUs during fiscal year 2010. The SVUs granted in fiscal year 2009 will vest and be paid at the end of fiscal year 2011 if the Company’s TSR equals or exceeds the Russell 2000 Index return for the 2009 through 2011 performance period, and if the recipients remain employed through the end of the performance period. Of the named executive officers, Messrs. Guichard, Dunston and Wolk were granted 165, 59 and 56 SVUs in fiscal year 2009, respectively.

Because the SVU performance goals were not achieved, no payments were made during fiscal year 2010 to any of the named executive officers under the SVUs granted in 2008.

Restricted Stock Units. During fiscal year 2010, the Compensation Committee decided to change the mix of long-term incentives to include restricted stock units (RSUs). This decision was in line with a recommendation from Mercer. The RSUs granted during fiscal year 20102011 to Messrs. Guichard, Dunston, Wolk and WolkBoyer include RSUs that vest upon the satisfaction of both service and performance criteria. The performance-based RSUs comprised 75% of the total RSUs awarded, while RSUs vesting upon meeting a three-year service criteriacriterion comprised 25% of the RSUs awarded. Subject to satisfying the associated vesting conditions, each RSU represents the right to receive one share of the Company’s common stock. The Compensation Committee believes this change will provide greater balance and stability to the Company’s long-term incentives for its key managers and named executive officers. Additionally, it will provide a form of long-term compensation that aids retention, encourages long-term value creation and aligns financial interests with the Company’s shareholders, while entailing a lower number of Company shares to be issued to employees than stock options and therefore entailing less dilution.